GLOBAL WEALTH ADVANTAGE PLANS

Protect your million

dollar dreams

GLOBAL WEALTH ADVANTAGE PLANS

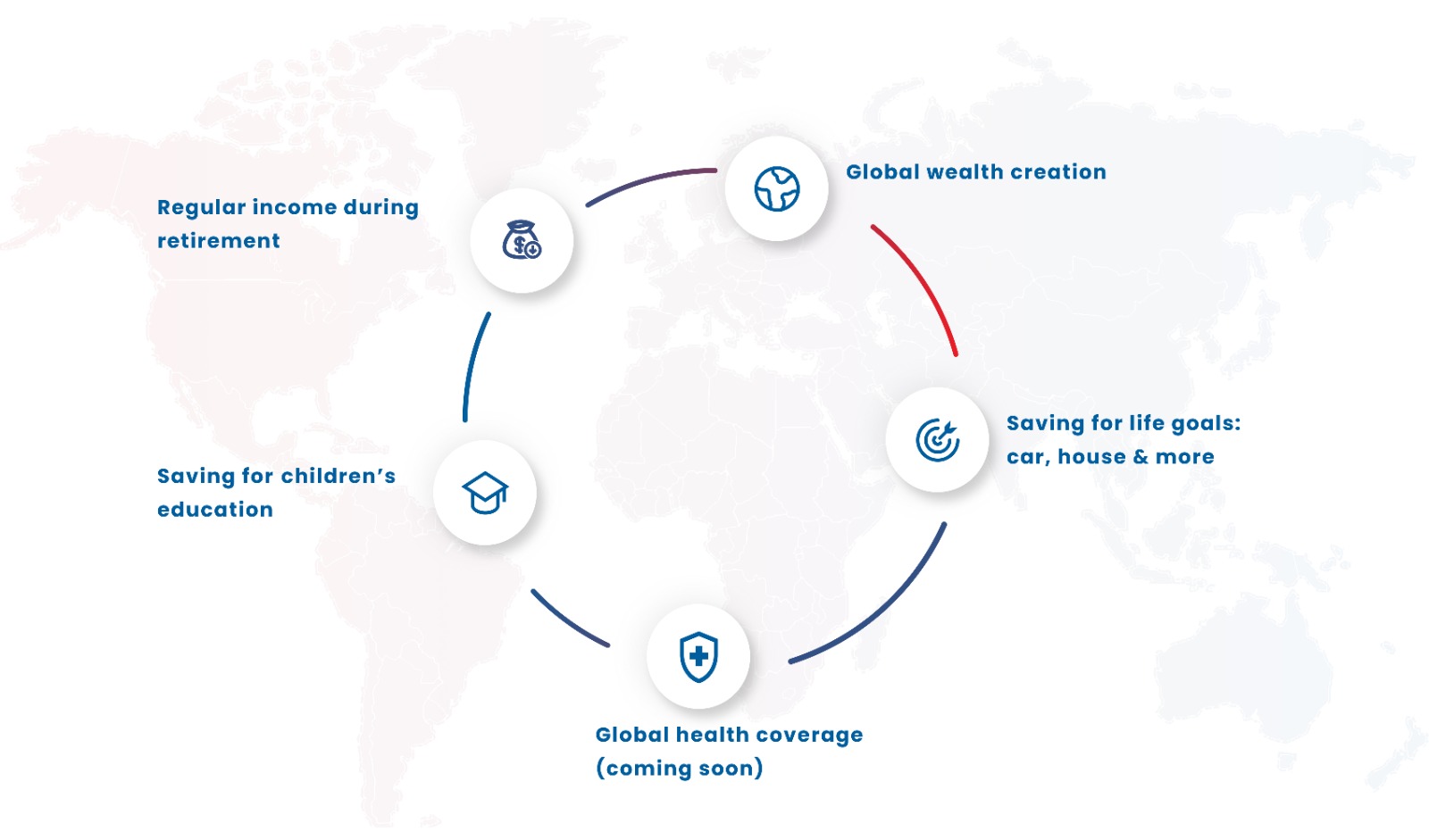

One Plan for Many Goals – Build Global Wealth, Retire Smart, and Enjoy Protection till Age 100

One Plan for Many Goals – Build Global Wealth, Retire Smart, and Enjoy Protection till Age 100

Build global wealth and stay protected

Growth

Stay invested and earn a Fund Booster—a percentage of your premium is added to your base Sum Assured at the end of 10 or 20 years.

Flexibility

Access funds when needed through Partial Withdrawals, or opt for regular income with a Systematic Withdrawal Plan starting Year 6.

Protection

Secure your family’s global future with a US Dollar life cover—payouts in one of the world’s most stable and widely accepted currencies.

One plan, limitless possibilities

Grow your wealth with flexibility

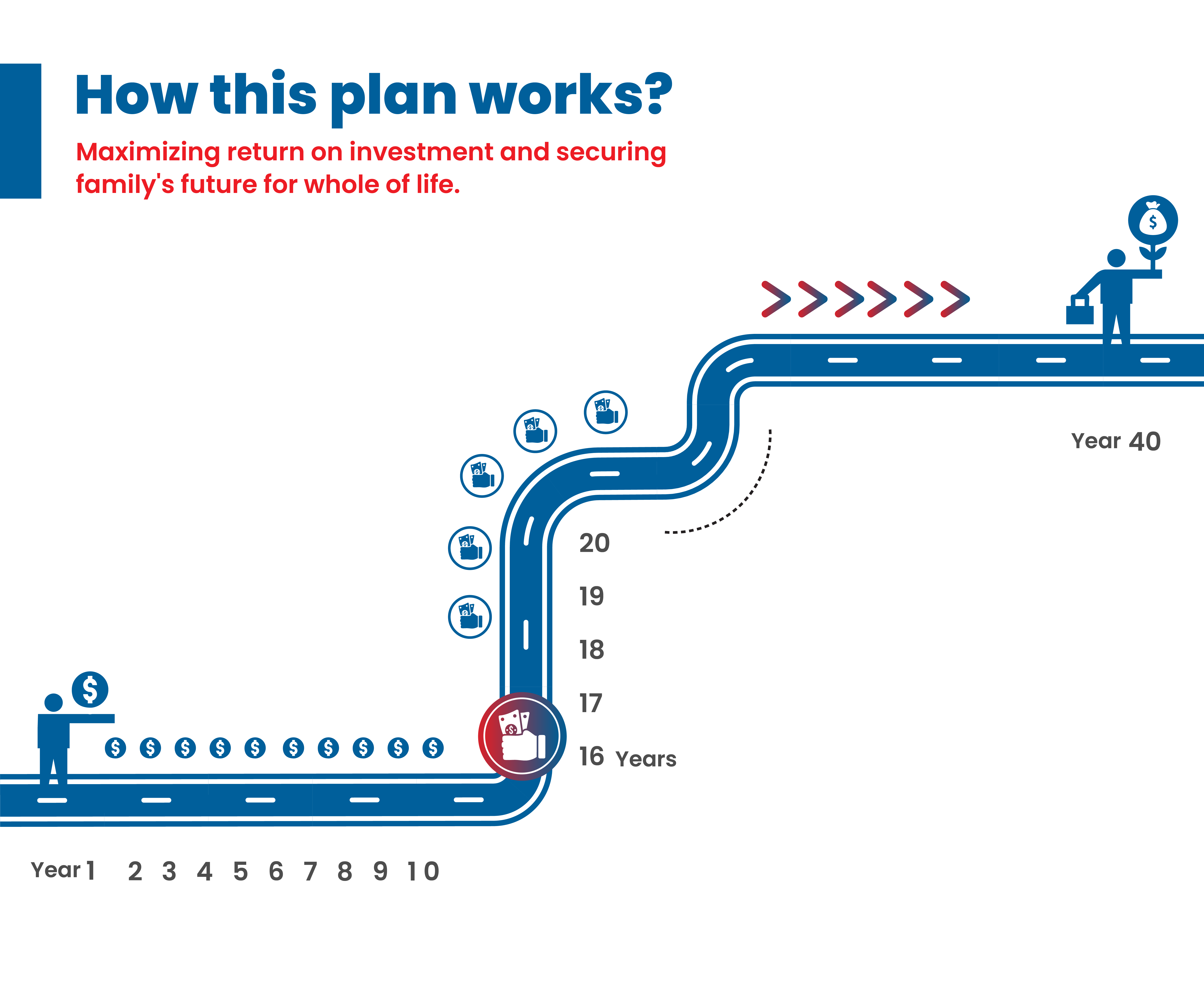

Maximizing return on investment and securing family's future for whole of life

Key benefits

Turn Your Investment into

Regular Income for years

Global Wealth Advantage Flexi Plan

With our Systematic Withdrawal Option, you can set up automatic monthly payouts that support your lifestyle for years to come. What's more - this income can steadily increase until the end of the policy term.

With our Systematic Withdrawal Option, you can set up automatic monthly payouts that support your lifestyle for years to come. What's more - this income can steadily increase until the end of the policy term.

Jon had opted for Systematic Withdrawal Plan of 5% of his strategy value to earn a regular starting Year 16 of his policy

Jon starts investing USD 100,000 annually at age 45 for 10 years

From Year 16, he earns USD 99,646 annually, growing steadily to USD 127,603 by Year 40.

Maturity Value USD 2.4 Mn

Total income = USD 5.3 Million (USD 2.4 Mn Maturity Value + USD 2.8 Mn through SWP)

Global Wealth Advantage Flexi Plan | UINIIOHDFC102ULV02.1

Disclaimer: Above figures are for illustrative purposes and for healthy life. Please note that the above-mentioned assumed rate of return of 8%p.a., is only illustrative, after considering all applicable charges. These returns are not guaranteed. Linked Life Insurance products are subject to market risks. The various strategies offered under this contract are the names of the strategies and do not in any way indicate the quality of these plans and their future prospects or returns. For more information, please request for your policy specific benefit illustration. * SWP pay outs are not guaranteed and assumed at growth of strategy value at 8% and are subject to the selected investment strategy allocation

Confused about investment decisions?

How will I know when to change investments funds?

Timely Updates: Receive regular updates and know exactly when to make changes for optimal returns.

How do I choose the right funds?

Investment Strategy Selection: You can get customized fund recommendations based on your financial goals.

Will anyone monitor the policy and returns?

Continuous Monitoring: We will help keep an

eye on your investments, ensuring they stay on track.

Will anyone guide me with the investment funds?

Dedicated Support: Our experienced advisors are here to guide you every step of the way.

WE'RE HERE TO HELP.

Our expert advisors provide personalized guidance to help you make informed investment decisions.

Investment Strategy Fund Selection Process

Global funds analysed

Funds shortlisted based on filtering criteria

Funds qualify and are back tested

Funds finalized across strategies

Composition of each strategy is continuously monitored using the above criteria

Plan details

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.