For Non-Resident Indians (NRIs) living in the Middle East, planning for medical emergencies is as crucial as managing remittances, investments, and family commitments. One such essential financial tool that often goes overlooked is critical illness insurance. As medical costs soar across the Gulf and severe illnesses become more common, having dedicated coverage can make all the difference.

Why NRIs in the Middle East Need Critical Illness Insurance?

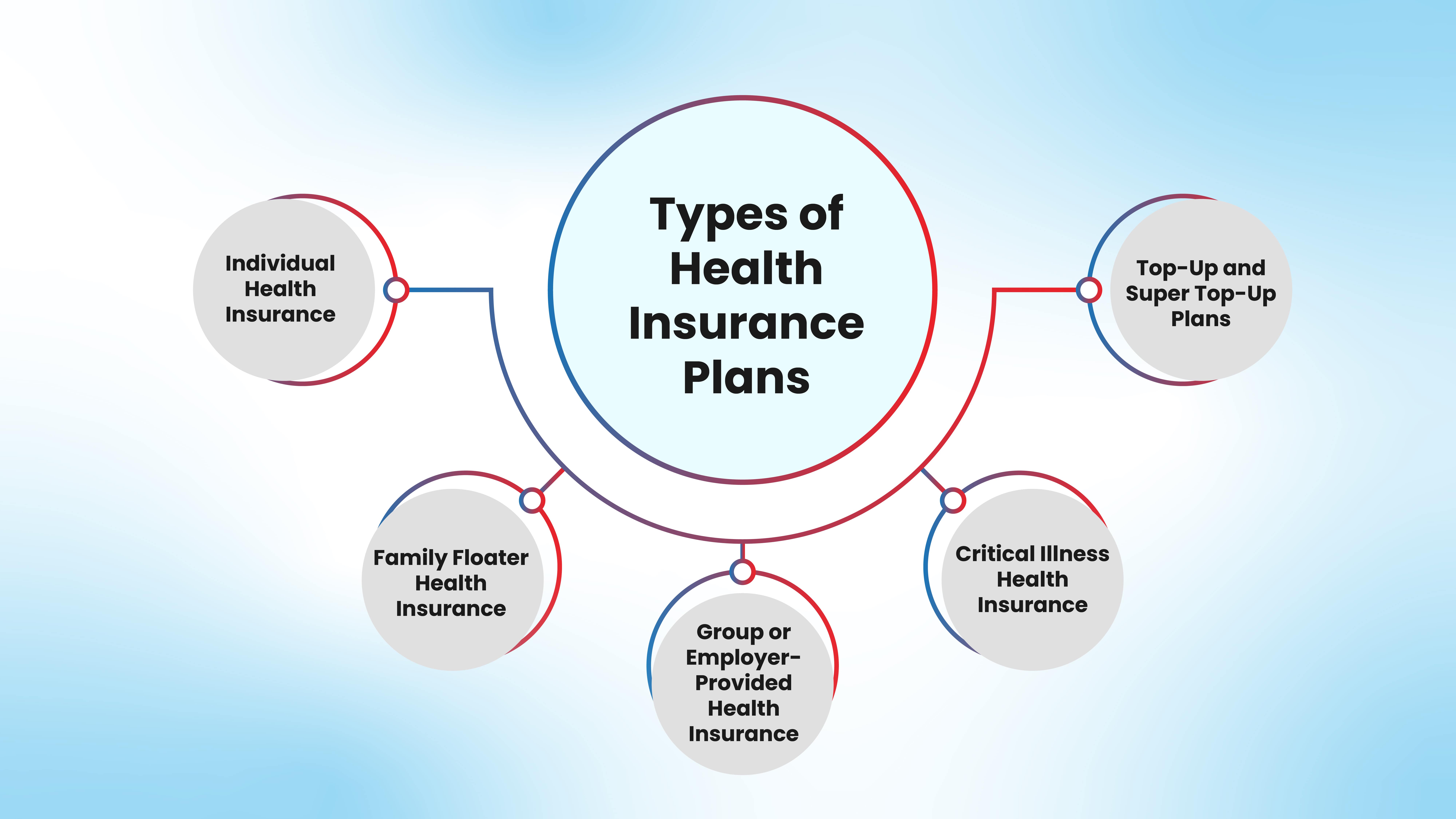

While basic health insurance is often a part of employment packages in countries like the UAE, Saudi Arabia, and Qatar, these policies usually don’t cover long-term care or critical illnesses. In such cases, NRIs may face out-of-pocket expenses for procedures like chemotherapy, organ transplants, or bypass surgeries.

Rising Healthcare Costs and the Financial Impact of Severe Illnesses

Healthcare inflation in the GCC has been consistently high, with advanced treatments costing anywhere from ₹15 to ₹50 lakhs. These expenses are amplified when factoring in diagnostics, follow-up care, and loss of income.

This makes a strong case for having NRI health insurance with critical illness cover, which provides not only medical security but also income replacement support during recovery.

How Critical Illness Insurance Provide Financial Security for Expatriates?

Unlike traditional health insurance, which reimburses expenses based on hospitalisation, critical illness insurance for NRIs offers a lump sum payout upon diagnosis of listed illnesses.

Why Critical Illness Insurance is Essential for NRIs?

High Cost of Medical Treatment for Severe Diseases in GCC Countries

Specialised treatments can quickly drain savings in private healthcare systems across the Middle East. Diseases like cancer, kidney failure, or cardiac conditions require long-term and expensive treatment, often exceeding the limits of employer-sponsored coverage.

Limited Employer-Provided Health Insurance Coverage for Critical Illnesses

Employer-provided coverage often excludes major health events or offers minimal reimbursement. These plans rarely accommodate long-term hospitalisation, overseas treatment, or rehabilitation costs.

Medical Inflation and Its Impact on Long-Term Healthcare Expenses

The cost of healthcare is rising every year, both in India and the GCC countries. This poses a challenge for NRIs planning long-term stays or retirement in India. Without proper planning, future treatments may not be affordable.

Ensuring Financial Stability During Treatment and Recovery

Severe illnesses can lead to job loss, reduced earnings, or temporary disability. For NRIs supporting families in India or the Middle East, this interruption in income can be overwhelming.

Key Benefits of Critical Illness Coverage for NRIs

Below are some of the most impactful benefits policyholders can expect:

-

A key benefit of critical illness insurance for NRIs is the one-time lump sum payout upon diagnosis. This payout is not tied to hospitalisation or expense receipts—it’s unconditional.

-

With HDFC Life International’s critical illness coverage plans, this lump sum can be used as needed—whether for treatment, travel, or taking time off work to recover.

-

These plans typically cover over 30 major illnesses, including cancer of specified severity, first heart attack, major organ/bone marrow transplant, stroke, and more.

-

Policyholders can use the funds to cover treatments not included in basic health plans, manage rehabilitation expenses, or support dependents during recovery.

-

The lump sum payout also acts as an income replacement mechanism, helping you maintain your household budget, continue education funding for children, and meet financial obligations without draining savings.

How HDFC Life International Supports NRIs with Critical Illness Insurance?

Comprehensive USD-Based Insurance Plans for Expatriates

HDFC Life International offers USD-denominated plans that align with the income and lifestyle patterns of Middle East-based NRIs. These plans provide:

-

High sum assured in USD

-

Financial consistency across borders

-

Premiums and benefits mapped to international medical costs

Financial Protection Against Medical Inflation and Currency Fluctuations

With healthcare inflation rising across India and the Middle East and currencies like INR being subject to volatility, having USD-based critical illness insurance is a strategic financial move.

HDFC Life International’s solutions protect policyholders against:

-

Escalating treatment costs due to inflation

-

Devaluation of benefits when repatriating funds to India

-

Budget disruptions caused by currency conversion rates

Flexible Plans Tailored to Meet the Healthcare Needs of NRIs

No two NRIs have the same medical or financial profile. HDFC Life International offers plans that allow:

-

Customisable sum assured

-

Choice of critical illnesses covered

-

Add-on options like accidental death or permanent disability benefits

-

Multiple premium payment frequencies (monthly, quarterly, annually)

Seamless Claim Settlement and Global Coverage Options

Indians worldwide need solutions that are effective and applicable globally. HDFC Life International ensures:

-

Digitised documentation and claim submission

-

International claims assistance teams

-

Direct support in GCC and India

-

Optional global coverage riders (in select plans)

This makes critical illness coverage for NRIs truly borderless and efficient during emergencies.

How to Choose the Best Critical Illness Insurance Plan for NRIs?

When choosing the best critical illness insurance for NRIs, they should consider the following factors:

-

Look for plans that cover 30+ illnesses, have high payout limits, transparent exclusions, and no major geographic restrictions.

-

Most plans include a 90-day waiting period and 30-day survival period. Start early and be transparent in your medical history to ensure eligibility.

-

Opt for policies with lifetime renewability and portability across countries. HDFC Life International plans are well-suited for mobile NRIs.

-

Compare standalone critical illness plans and riders on life or health insurance. Standalone plans offer broader coverage, while riders are cost-effective but may come with limitations. HDFC Life International provides both options.

Why NRIs in the Middle East Must Secure Critical Illness Insurance?

Medical crises can destabilise even the most well-managed finances. For NRIs, critical illness insurance is a strategic shield that protects long-term goals and lifestyle aspirations. HDFC Life International’s plans are crafted with global Indians in mind.